Overpoached eggs: The hidden risks in the RIA model today

For the last ten years, every RIA has been bemoaning the need for “differentiation,” revealing a stark misunderstanding of what the real issues are. Wealth firms no longer understand what they are selling to the marketplace that has dramatically changed since the Boomers called them into existence.

In the airport recently, I (Nick Richtsmeier) was preceded in line by a young man whose plucky T-shirt featured the accusation, “Brunch is for Assholes.” I was grateful for the allegation because it answered one of the internet’s longstanding questions (#AITA?)… and yes, dear friends, I am the asshole.

I love brunch.

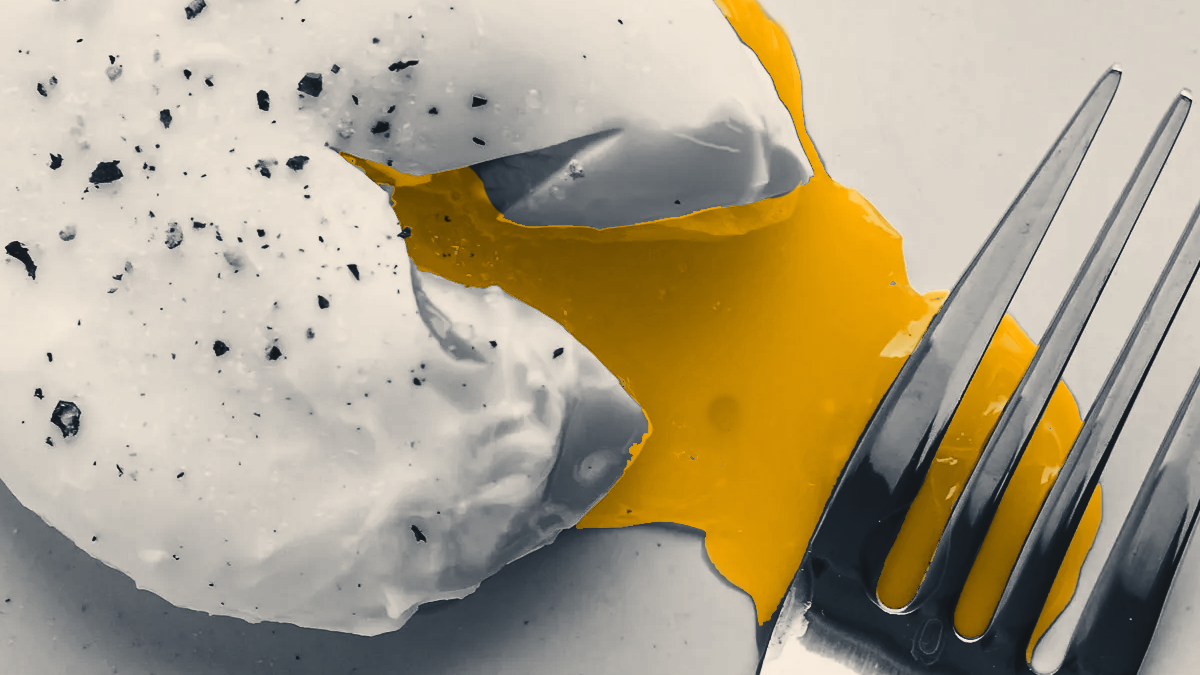

It is the world’s perfect meal built around the world’s ideal protein: eggs. And the undisputed king of brunch is the poached egg—a tiny pocket of perfectly emulsified sauce in a protein-packed package. Only fools would question its supremacy. And you’re not a fool, are you?

Part of what makes the poached egg so supreme is its perfect mix of simplicity and perceived degree of difficulty. Under poaching the egg is the obvious faux pas; it creates a mess and is generally inedible. Everyone can see the disaster. Over-poaching the egg is a different story. By all appearances, it looks pretty damn good until you cut into what’s inside.

Exactly like what’s happening in most wealth management firms today.

INDEPENDENT ADVISORS' RISE TO PROMINENCE

Once upon a time, in the strange time known as the 1990s, a transformational industry was born: The Registered Investment Advisor. This distinction had been codified in law for decades. Still, in the 1990s, Baby Boomers, now in middle age, demanded independent and more personalized advice than their mutual fund brokers and wirehouse firms could offer.

Boomers had big questions about the future: retirement, new investment opportunities, college savings, and advanced health care. They saw their parents spend through pensions like water and were the first generation whose later years would be primarily defined by their investment portfolios.

Over two decades, RIAs became the new Main Street of Wall Street, slowly taking over assets, clients, and influence in the marketplace.

Financial professionals, mainly a motivated and inspired crop of entrepreneurs, flocked to the opportunity. The “RIA” designation would free them from the increasingly contentious FINRA regulatory environment, they would have no allegiance to sell in-house products from a parent insurer or brokerage house, and they could focus on where their passions lay: making a difference in clients' lives.

Over two decades, RIAs became the new Main Street of Wall Street, slowly taking over assets, clients, and influence in the marketplace. Most RIAs did not need to distinguish themselves from each other; they simply had to be “independent,” “comprehensive,” and “full-service,”… all entendre meant to level passive criticisms at the other more commissioned corners of the industry.

To abuse our previous metaphor, driven entrepreneurs and generally good eggs were diving into water simmering to a boil. The Boomer generation’s scale, willingness to delegate wholeheartedly to professionals, and relative affluence drove record growth across the industry. Success required skill, but the heat came from all around.

FINTECH POACHES THE EGG

Before the early 2010s, running an RIA was a labor-intensive business. Compensation for staff advisors and planners was far above other-industry norms, and the industry's trademark personal touch required an endless supply of person-hours. I remember it clearly. Every meeting was a problematic scale decision: the amount of prep time sometimes far exceeded the client's financial benefit. There was no time to train junior advisors, and they failed en masse.

Technology to the rescue.

Like any growing industry, we needed scale to survive. A national collection of micro-firms could not serve the increasing demand. Baby boomers were still retiring, and the ones we’d taken on as clients ten years and 15 years before had ongoing service needs.

An anathema question began floating around the industry, “What happens when a practice is full?”

No CEO is content with capping their growth. But how do you unlock more scale? The answer was as apparent as the internet: technology. The first generation of significant wealth tech firms, from eMoney to Envestnet to Orion, broke onto the scene over five years. They acquired clients at a record-setting pace. Financial firms now had the resources to research faster, distribute plans digitally, and grow larger books of business with a more manageable staff investment.

Planning processes were systematized. Portfolio reporting and client review meetings are baked into client portals. The sprint of innovations in Wealth Tech leading up to COVID-19 was legendary, accelerating the growth of the industry as a whole in all factors: managed assets, number of RIA firms, revenue, and increasingly a word not often heard ten years before: EBIDTA.

CAPITAL CALLS

Too many firms are waiting on a future high-multiple acquisition. They are waiting on a fantasy.

One central question hung over the marketplace of RIAs in the mid-to-late 2010s: Could owners and investors make money on an enterprise RIA model? The role of private equity in the RIA space deserves its own reflections, so we won’t attempt to dive deep here. Still, it’s essential to recognize that the confluence of WealthTech, a failed 2nd generation of RIA leaders (due primarily to lack of development), and the powerful incentive of PE infusion transformed the industry.

A once entrepreneurial space became industrial (while still inviting a meaningful number of new firms every year, leaving the other sectors of financial services). The infusion of capital and the drive to enterprise scale set new demands for how RIAs are organized, run, and marketed.

For the last ten years, every RIA has been bemoaning the need for “differentiation,” revealing a stark misunderstanding of what the real issues are.

As a broad category, wealth firms no longer understand what they are selling to the marketplace. Doubling down on “independence” and “comprehensive” and showing their portfolio charts as if their primary competition was still Merrill Lynch or Edward Jones.

The RIA industry is now the leader in the space and is growing primarily though market-based returns and consolidation efficiencies.

Most firms are, in the metaphor of this article, already poached. Yet they are staying in the boiling water, waiting for an acquirer to snatch them out at some ungodly multiple in the future.

They are waiting on a fantasy.

Most firms who manage between $100M and $2B in assets are slipping into mediocrity without knowing it. Remember: from the outside, you cannot tell when an egg is over-poached. Too many owners are being lulled into complacency by ongoing tales of big multiples, savior PE firms, and one more magic WealthTech widget that will save the day.

WealthTech has lost its innovation edge, broadly shifting to stability, ousting creator CEOs and replacing them with operators who will feed EBIDTA to their ravenous investors. A few startups show up on the Kitces map every year, but nearly without exception, they continue to play by the rules of their enterprise's older siblings. You will never gain meaningful market share by trying to out-Orion Orion. Envestnet is pivoting to embedded finance, a tool for banks and brokerages, shifting its innovation portfolio to newly hungry clients outside of the RIA space.

RIA founders love to both bemoan loudly and quietly lust after the possibilities of a capital partner. But capital is never the catalyst. Private equity’s involvement in the RIA space has almost no effect on the internal stagnation of the larger body of firms. It’s simply a red herring to distract from all the over-poached eggs sitting in lukewarm water.

A DIFFERENT KIND OF RIA

Imagine the RIA principals in 2000 saying, “We’re going to do basically what we did in 1975 except with email instead of typewriters.” Had that happened, the independent wealth channel, which has been a boon to millions, would have never happened.

Our work shows that a select subset of RIAs are ripe for the trip from entrepreneurial to enterprise (what we loosely map as the journey from $5M in revenue to $100M in revenue). In contrast, most of their peers stagnate in the lower quadrant of that journey and will eventually get acquired, and their legacies are consumed in the process (though the payouts are still good).

The founders and leadership teams who still want to make a difference in their clients and team members' lives cannot continue to go to market as they did for the first 20 years of their business. They cannot just take their best 2005 ideas and add the efficiency of technology. 2025 in the business of wealth will be as far from 2000 as 2000 was from 1975.

Imagine the RIA principals in 2000 saying, “We’re going to do basically what we did in 1975 except with email instead of typewriters.” Had that happened, the independent wealth channel, which has been a boon to millions, would have never happened. The willingness to imagine a different way of building a firm and delivering value transformed the industry.

And that kind of ingenuity is what will be required again.

As you read this, most of your peers in the RIA space are actively building for stagnation. They feel like they're not. They may even look like they’re not. Consolidations, market gains, and not-yet-fully-compressed margins are masking A LOT.

But those safety nets should do more than buy RIA founders time to flounder. It should give them time to adapt and grow—something you will not do by rehashing the same business advice recycled by the industry in every trade magazine and industry conference for the last decade.

Our analytics can examine the fundamentals of a firm’s go-to-market and reveal the risk it’s taking on. Unlike marketing firms in the industry, we don’t just apply some “proven playbook” (code for tired tactics). We custom-build solutions for firms who want to make the enterprise journey and recognize that they need fresh thinking.

Want to know more? Unsurprisingly, I’m always up to meet for brunch. 😎