Organic growth fails on purpose

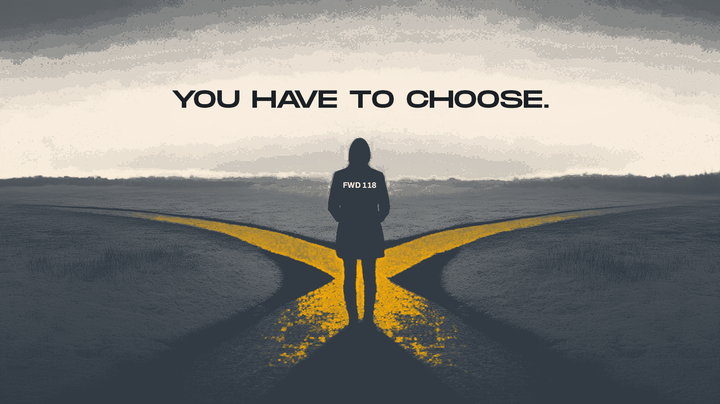

There are only two business plans left for growing RIAs: Build to Sell or Build to Buy. And for all the firms not doing either, they are counting on running out a clock that is moving faster than even the most cash-sheltered RIAs can imagine.

The game has changed for RIAs, and their tool for avoiding organic growth is not going to save them anymore.

A recent article from a wealth management marketing agency made the audacious—in light of readily available facts—that all advisors needed to do was to start putting content on the internet about what they do for clients suddenly millions (their word, not mine) of dollars of revenue would come flowing unsolicited in the front door.

This is, of course, categorically insane.

If all RIAs had to do was to post a bunch of blogs about Roth IRA conversions, tax harvesting, direct investing, how to retire as a business owner, planning for your legacy, what to do with your old 401k, and all the other standard milquetoast fare, the M&A revolution would never have happened. It wouldn’t have needed to.

Small—to mid-sized RIAs would have unlocked organic growth, expanded on their own free cash flow, and wouldn’t have needed to outsource their lead gen to the Schwab/Fidelity duopoly through their referral programs.

If only advisors had websites and blogs and social media profiles and "did SEO" (as the infamous Kitces report suggests is the killer app), then clients would have come stampeding into their pens much like they did through the steak dinners and of the early 2000s.

But, of course, by and large, these simplistic mass-produced strategies don’t work, even if they (occasionally) once did. Advisors are being sold bills of goods from decade-old internet marketing logic that barely worked then and definitely won’t work now.

RIA Myths Fuel Growth Resistance

The elephant in the room is that RIAs' resistance to organic growth (broadly) is not a function of marketing tactics. Marketing is where you may feel the pain, but the injury is much farther up the org chart. I’ve been sitting in these conversations now for almost 20 years, and it still shocks me how the same rhetoric with the same buzzy buzzwords float around the trade publications and industry spokespeople as if they were revelations:

- Advisors need to use tech to save time to focus on business development - FALSE.

- Tech rarely saves advisors time because it gets bought but not implemented. And that saved time, if it exists, is rarely deployed to business development because no one (with a few exceptions, stay tuned) knows what will work. AI will only make this work as the illusion of tech enablement now has the gloss of a global hype cycle, only leading RIA firms to spend more money on software that doesn’t fit their client experience.

- The industry is healthier than ever. - FALSE.

- We are finally hearing a "tailwinds turn to headwinds" message, but it is rare and vague. The truth is that the mass infusion of private equity at near-zero interest rates combined with consistently rising markets brought the industry a decade of delay to face its organic growth issues. With the potential that they could stay the same, not deal with structural problems, and still cash out at 10x EBIDTA, founders were incentivized to maintain the status quo. Until now.

- M&A activity will continue apace. - FALSE.

- A recent trade publication’s recasting of this week’s Tibergien Report was quick to note a near 15% YOY reduction in buying activity but buried the fact that this reduction was exceeded by a near 20% YOY reduction in EBIDTA multiple. All while claiming that valuations were unaffected. The industry gatekeepers have been careful not to imply weakness in M&A or point out that much of the activity flows from mass aggregators that function like VC firms, turning RIAs into storefronts for their centralized services and corporate RIA.

The RIA ecosystem is legendary in its ability to bury the lede. Sycophancy is baked into the business models of many vendors. When media outlets and industry guardians paint sunshine on rain clouds, they protect RIA leaders from what they need: real insight based on real problems.

The New Era: Selective Consolidation

Successful leaders will unwind the ongoing myth of organic growth in the RIA space, how the real issues are hidden, and what growth-seeking firms need to do to pull themselves out of the echo chamber. We have entered the Era of Selective Consolidation marked by three themes:

- Successful Buyers will be more selective. Everything costs more and is worth less. The easy purchases have already been gobbled up.

- Generic RIAs will get lapped. Boasting distinctions like "comprehensive planning," "client centricity," "bespoke asset management," and other industry tropes will leave RIAs either sitting on the shelf longer or getting sold for parts at an aggregation firm simply needing to boost its financial fundamentals to improve future financing terms.

- Successful Sellers will have developed custom answers to organic growth. These solutions can't depend on the custodians, instead having targeted communities (geographic, demographic, and psychographic) where they’ve proven specialized client experience and brand reputation. (Hint: none of the phrases in Item 2 qualify as specialized client experience.)

There are only two business plans left for growing RIAs: Build to Sell or Build to Buy. These pull the firms from their stated "client side of the table" mission. And for all the firms not doing either, they are counting on running out a clock that is moving faster than even the most cash-sheltered RIAs can imagine. Internal successors are not up for the job. Talent operations are failing (with turnover at record levels across the industry). The business acumen bar required to build a growth-capable firm for the future is higher than ever, and founders/leadership teams are largely unprepared.

Those without a growth strategy to sell to their future owners will be left begging for the least reputable acquirers to sweep them in under the shaggiest of rugs. (We won't name names here.) A fate that is not only bad for legacy teams, but traumatic for clients. Just ask the clients of the artist currently and formerly known as United Capital.

Let’s say your RIA firm is ready to look in this truth-telling mirror. Like many of our clients, perhaps you recognize the trends in the industry that aren’t often said out loud and want to find a way not to get swept up in the waves described here. With the limited space an article like this allows, here are five critical steps for firms that wish to buy and firms that wish to sell, and how organic growth is a required element for either’s financial outcomes:

Organic Growth Checklist for Buyers

- Decide who you want to be, and "bigger" is not an answer. The homogeneity of the consolidators continues to bland the industry while and the dependency on the custodians is strangling organic growth strategy. Firms that wish to plan beyond the next 24 months have to make definitive decisions about their future firm identity. No buzzwords allowed.

- Define a target client psychographic, not a demographic. No asset minimums, professions, or "we serve people who love dogs" are required. Successful integrative acquirers have to be more savvy than that. They have to build toward a particular client's emotional map: how they feel, what keeps them up at night, what soothes them, and what they need to make better decisions over time.

- Segment by demographic. That psychographic map is required to be segmented by demo so that you can acquire it according to your well-designed segmentation. This segmentation should power integrated teams of marketers, "hunter" advisors, and CX-obsessed advisory teams.

- Define a segment-specific client experience. Spinning up a "MFO" offering is not going to do it. To be in the top tier (or even competitive middle tier) of integrative acquirers, you need to build structured SOPs that produce repeatable client acquisition, onboarding, and outcomes for sharply defined target communities across your geographic targets.

- Invest in brand-led, organic growth. We’re not talking logos here. We’re talking about defined and carefully crafted positioning and reputation followed through with a mid-21st century relevant marketing operation. Not, as we mentioned above, some mass-produced clone of 2015’s content marketing low bar. This will cost you money. 1-2% of gross revenue to marketing will not cut it. You will need to strategically invest to get ROI here, but the brand value for client, talent, and firm acquisition will pay back in spades.

Organic Growth Checklist for Future Sellers

- Abandon your anchor to the past. How you grew from Y2K through the Pandemic is not relevant. That world is gone. Trying to reconnect to that world through vendors and strategies that the entire rest of the industry is using will only set you back in time, money, and trust.

- Decide to be different. If we can take your logo off the website and your "about" page, and you could be confused with any other RIA in the business, you’re set up to fail. You’ve got to pick a target clientele that is as narrow as possible, build a psychographic profile (see above) of that clientele, and invest in being the go-to expert for that person.

- Decide what you want to be bought for. If you’re just the firm selling its clients and revenue stream, expect reduced multiples and no leverage in the selling process. Your legacy will get washed into the sea of a mass acquirer. Instead, build a 5-year roadmap toward your selling value proposition: Who you will be and why you will be valuable for your future ideal buyer.

- Build a targeted growth engine. Your best strategy is to add clients who share key characteristics, allowing you to streamline operations, manage overhead, and over-deliver value. Only invest in business development that grows that targeted community. Others will come, of course, but your investment in talent, marketing, and messaging must be hyper-focused for you to attract the clients (and future buyers) you want.

- Minimize advisor-led marketing initiatives. Most advisors are unskilled at business development and have a novice understanding of how to go-to-market. They are experts and meeting their clients needs. But appeasing the public and marketing are competing forces. You don’t win business by being what people asked for. You win business by being what they didn’t know they needed. That’s the difference between advice and marketing.As the management aphorism goes, always have the end in mind. Today’s RIA competitive landscape makes this more true than ever.

The plague that will kill half the firms is Genericism, leaving only the mega-RIAs and the hyper-niche boutiques in its wake. We are in a new era, and every founder must shift their attention, strategy, and definition of successful growth.