(and the one question they should be)

Capital Idea Edition 07

We talk to a lot of RIA leaders and founders every year. Because we aren't vendors for marketing, but collaborators for growth across the org, we get a unique view into what's on people's minds and the questions they are asking beyond the tactical and the pedantic.

The theme (not surprisingly): How to solve for organic growth.

Unfortunately, that question itself is misunderstood by many founders and the marketing folks who work with them. Due to how the RIA industry evolved, the relationship between marketing and organic growth is fundamentally flawed, and central to the reason why organic growth has stalled so dramatically in the last half decade.

Quickly, leaders turn to the Schwab or Fidelity surveys and thought leadership from gurus in the trade publications, trying to find a morsel of truth to build a future growth vision on. What they will find there will be unsatisfying. How RIAs report on, budget for, and even define their marketing and growth efforts is so non-uniform across the industry that any metric trying to normalize them will misdirect you. As you'll see below, even what constitutes "marketing" at an RIA is so broadly (and often poorly) defined that recipes for failure abound.

The industry is at an inflection point where nearly all growth efforts are about to be subsumed in the attention-consuming fire of M&A. The only way for firms to control their own destiny is to control their growth strategy, and to do that, you've got to ask better questions.

The Five Big Questions of 2024 So Far

- What should we do about search?

The one marketing tactic that seems to have permeated the industry is SEO. This is ironic because, as an industry, wealth advice is one of the least well-suited to capitalize on SEO beyond just basic geotargeting and local reach. Only a minority of firms can win the "best investment firms in Birmingham" Google game by buying up paid ads in that space.

As I've written about at length (from a long list of sources), the search industry is facing a generational disruption, much of it self-induced. While there are inches still to be won here and there in the search game if you're starting your marketing conversation by trying to figure out how to game Google, you're starting in the wrong place.

- How do we get our content out?

Distribution is 80% of the content game, but it's the least important 80% now. All signs point to a race to quality and differentiation in the face of AI. This means you can put your "How to Retire Early" blog in 1000 places, and it will matter little because the system is rigged against mass-produced generic content.

This is the opposite of how the internet worked 10 years ago. So, many marketers who made their successes (and their credibility) in that game are facing this new era with one foot in the past.

The question isn't first, "How do we distribute?" but instead, "What do we have to say?" This puts pressure on value-creator departments (wealth planning and asset management) and niche specialists (family wealth advisors and those specializing in tight markets) to deliver truly differentiated value in content creation.

This forces marketing to be an interdisciplinary department, not a fulfillment center for advisor and C-suite fantasies, a shift for many advisory firms.

- Should we get back to events?

Short answer: Yes.

Long answer: Probably, with a lot of caveats. Plate-licker dinners are out. People can get restaurant food delivered to their front porch; they don't need to listen to your seminar. Similarly, the classic golf outing, whiskey tasting, etc., may get your clients together (they already like you) but will be an increasingly challenging place to generate referrals.

The only game in hospitality is delivering value without the expectation of reciprocity. So throwing a $2000 wine tasting and expecting three clients to sign up from it is probably a game you don't want to play. Events must live in an ecosystem of connection, cultivation, and value delivery, bringing marketers and advisors into constant collaboration and dependency.

Dramatically transforming the relationship.

- How much money should we spend on marketing?

Since we're nearing budget season, this question is heating up. The Schwab and Fidelity surveys annually skew the answer to the point of oblivion as firms vary wildly in how they calculate marketing spend and what they call marketing.

In most firms, large portions of marketing talent are consumed doing comms (a completely separate discipline from marketing) — getting messages out to clients, shipping client newsletters, writing emails for the CEO, even writing internal emails, and occasionally PR. There is a master skill to comms and one that advisory firms are wise to take seriously. It's just usually marketing. Additionally, many firms only report what they would consider "advertising" as marketing, not the time, effort, and payroll their spending producing organic reach which shifts your investment.

My best answer, though, is "as little as possible." Marketing is not a well-developed or well-understood function within RIAs. The good news is that it's not the only tool in the growth toolkit. Much growth can be done with minimal marketing involvement if your other growth engines are running. And you're probably spending a lot of attention, if not money, on "marketing" stuff that doesn't actually move the needle.

- What should we do about AI?

I hesitated to include this because it's such a hype-driven/vendor-driven question. The fintech consultants and LinkedIn bros are beating the drum on this to capture a wave of attention, but in nearly every case, there's no there there.

A recent study showed that 77% of AI users found it made their job harder, not easier. Add to that fact that you work in a highly regulated, trust-dependent business, you cannot afford the typical AI hallucination or spammy outcomes.

Minus some nice pragmatic tools like meeting transcription and some next-best-action prompts inside your CRM (which have been around for years), this tech is simply not ready for broad usage. This is bad news for Silicon Valley, which has spent $1T on a hype cycle with no clear way to earn it back.

The One Question

This leads me to the one question RIAs should be asking before the 2025 planning kicks off.

What is slowing growth that we can't see?

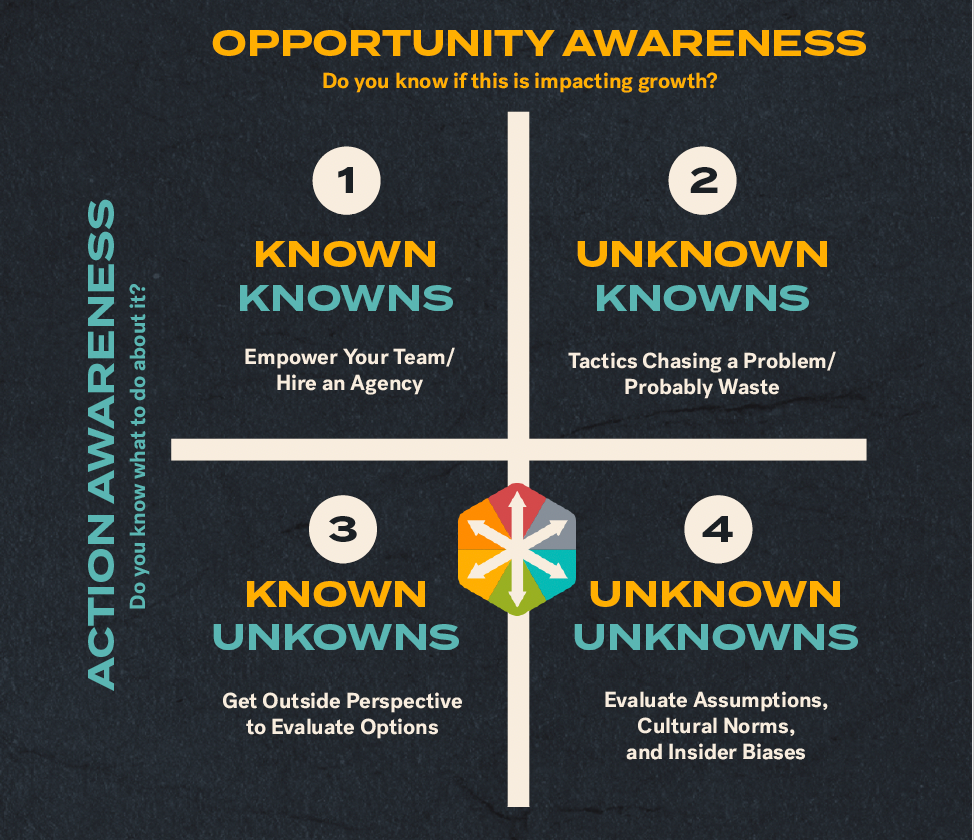

So much of the organic growth conversation, generally and marketing specifically, centers around what I call "Known Known" questions. You know the location of the opportunity (SEO) and your basic options of what to do; you just need to pick a tactic, a vendor, and a budget. Answering Known Known questions feels smart and works great in a world where 90% of growth happens in the Known Knowns (for example, 2015, in the RIA space).

That is not our world today.

Today, the majority of growth opportunities are in the blind spot: The Unknown Unknowns—the place where what I call Insider's Dilemma rules. As an insider, you don't see the furniture, the wall color, or the patterns formed when you were half the firm you are today, which define reality. That (very normal) blindness that happens the longer you are inside and the more authority you have, is the driving reality in hindering organic growth at RIAs. And we see it over and over again.

You've got to have a systematic process to efficiently and with relative objectivity examine the Blind Quadrant and unearth what the Insider's Dilemma is innocently hiding.

As always, if you want to talk with us about how we do this, you can reply to this email, and I'll personally put some time with you on my calendar.

Stay brains on, heart open, forward progress.